Information provided below will guide you to:

● Introduction of Wholly Foreign Owned Enterprise (WFOE)

● Documents Required & Registration Procedures of WFOE

● Accounting services after WFOE Incorporated in China

● 1 Year All Inclusive Package (Company Formation, Accounting and Audit All Included)

● De-registration of a Company (WFOE) in China (Shanghai, Beijing, Shenzhen)

Company Dissolution in China

PROCEDURES, CHECKLIST AND COSTS OF A WFOE DEREGISTRATION

PROCEDURES:

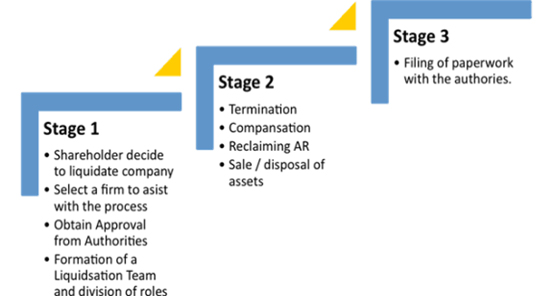

Steps to Closing a Company in China

1. Apply the dissolution to the foreign investment approval authority

The foreign invested enterprise shall, prior to the outset of the dissolution and liquidation procedures, require the approval of the original examination and approval authority of the enterprise (the local foreign trade and Economic Cooperation Commission), and provide the following documents to the original approval authority:

01. The Cancellation registration form

02. Board resolution or the resolution of shareholders’ meeting

03. Business License

04. Approval Certificate

The approval document of agreeing the dissolution of the enterprise will be issued out in 10 working days after the approval authorities received the application of termination and related materials whilst the announcement of the dissolution will need be made on the management system of the national foreign invested enterprises.

2. The establishment, filing and announcement of the liquidation group

The enterprise shall set up a liquidation committee within 15 days upon approval date of dissolution and start liquidation in accordance with the law. The liquidation committee shall be composed of the legal representative of the foreign invested enterprise, of the creditors and the competent authorities concerned and with the engagement of the Chinese CPA and attorneys.

The liquidation group shall make the record with the administrative department for Industry and Commerce of the place where the enterprise is located after the establishment and submit:

01. The for record application form for the company signed by the chief of the liquidation group (with company seal)

02. The certificate of the designated representative or agent signed by the company with company seal and the copies of the ID card of the designated representative or the authorized agent.

03. The resolution of the shareholders' meeting regarding the establishment of the liquidation group (signed by shareholders representing 2/3 or more of the voting rights, the shareholders shall be signed by the natural person and the shareholders of the non-natural person shall be signed with the company seal)

04. The copy of couterpart of legal person business license of enterprise;

05. Other documents required by Industrial and Commercial Bureau.

The liquidation group shall notify the creditors within ten days from the date of its establishment, and shall make a public announcement in the newspaper within sixty days.

3. The cancellation of all kinds of work

Ⅰ. Tax clearance and cancellation of the Tax Bureau

The required documents:

01. A written application for cancellation of tax registration

02. The registration form for Cleaning up and destroying blank invoice

03. The transfer list of the enterprise gold tax card and IC card

04. The tax registration certificate

05. Invoice book

06. Clear the tax and submit Tax Clearance Declaration Report (an audit report prepared by CPA firm)

07. The resolution of the board of directors or other relevant documents, or the notice of termination or agreed to terminate the relevant resolutions issued by the economic and Trade Commission and other relevant departments

08. The statement of enterprise income tax of last year

09. Balance sheet and income statement for the last period

10. Liquidation audit report to be provided (for foreign invested enterprise only)

11. The cancellation of the contact list of tax rebate (exemption) of the export goods

12. The inspection notice of the VAT general taxpayer

13. Other relevant documents and materials required by the tax authorities

Approval time: 10 working days

Ⅱ. The cancellation of the Custom

The required documents:

01. Application for cancellation signed by company stamp

02. The resolution or decision made by the supreme authority stipulated by the AOA

03. The custom certificate

04. The copy of couterpart of legal person business license of enterprise

05. Other relevant documents required by the government

Approval time: within 10 working days after the submission of all required documents

Ⅲ. The cancellation of the Industrial and Commercial Bureau

The required documents:

01. The cancellation registration application form for the foreign invested company signed by the chief of the liquidation group

02. The approval letter of agreeing the cancellation of the liquidation from the orginal approval authority

03. The resolution or decision made in accordance with the law

04. The recorded and confirmed liquidation report

05. The cancellation of the Tax and customs registration certificate;

06. The cancellation of the registration certificate of the branch offices

07. The IC card and the copy of counterpart of legal person business license of enterprise;

08. Other relevant documents required by the government

Approval time: within 30 working days after the submission of all required documents

Ⅳ. The cancellation of the foreign exchange

The required documents:

01. Approval time: within 10 working days after the submission of all required documents

02. The resolution or decision made by the supreme authority stipulated by the AOA

03. The liquidation report or the documents of the creditor's rights and liabilities cleared by the liquidation organization

04. The original copy of the foreign exchange registration certificate

05. The copy of couterpart of legal person business license of enterprise

06. Other relevant documents required by the government

Approval time: within 20 working days after the submission of all required documents

Ⅴ. The cancellation of the bank account

The required documents:

01. Application for cancellation signed by company stamp

02. The photocopy of the cancellation of the Industrial and Commercial Bureau

03. The other relevant documents by the bank where the account was opened

Approval time: within 2 working days after the submission of all required documents

Ⅵ. The cancellation of the technical supervision Bureau

The required documents:

01. Organization code certificate and IC card

02. Application for cancellation signed by company stamp

03. The photocopy of the cancellation of the Industrial and Commercial Bureau

Approval time: Will be handled immediately after the submission all the required documents

Ⅶ. The cancellation of the Bureau of Statistics

Required documents:

01. The photocopy of the cancellation of the Industrial and Commercial Bureau

02. Statistics Registration Certificate

Approval time: Will be handled immediately after the submission all the required documents

Ⅷ. The cancellation of the Bureau of Finance

The required documents:

01. Original copy of financial registration certificate

02. Application for cancellation signed by company stamp

03. The photocopy of the cancellation of the Industrial and Commercial Bureau

Approval time: Will be handled immediately after the submission all the required documents

Ⅸ. The cancellation of Public Security Bureau

The required documents:

01. Company stamps

02. The original for record registration for the company

03. Application for cancellation signed by company stamp

04. The photocopy of the cancellation of the Industrial and Commercial Bureau

CHECKLIST:

Documents required for WFOE de-registration:

• Originals of Certificate of approval, Letter of approval, Business License

• Taxation registration certificate (2 originals)

• Enterprise Code certification (2 originals)

• Statistics registration certificates

• Foreign exchange accounts permits

• Copy of Legal Representative’s passport (first page, signature page and most recent immigration records’ page)

• Bank Account Certificates

• All chops of WFOE (Company chop, finance, Legal representative)

• All accounting related documents: bank statements, invoices of WFOE expenses

Information provided below will guide you to:

● Introduction of Wholly Foreign Owned Enterprise (WFOE)

● Documents Required & Registration Procedures of WFOE

● Accounting services after WFOE Incorporated in China

● 1 Year All Inclusive Package (Company Formation, Accounting and Audit All Included)

● De-registration of a Company (WFOE) in China (Shanghai, Beijing, Shenzhen)

If you have any questions about your China business, please feel free to contact us for free.

Contact us in Shanghai, Beijing, Shenzhen or HK for more details:

Jilian Consultants

Telephone:+(86)21- 6071 0208

Email:info@ijilian.cn

Address:Rm2008, O.T.C Building, No.912,

Rd Gonghexin, Shanghai, China.

Our consulting specialist:

Ms. Charlotte Li(English & Mandarin)

Mobile: +(86)158 2143 8339

Email: charlotte.li@ijilian.cn

Skype: charlotte.li

WhatsApp: +86158 2143 8339

Ms. Aliena Wan(English & Mandarin)

Mobile: + (86)18721579300

Email: awan@ijilian.com

Skype: Aliena Wan

WhatsApp: +8618721579300

Office Time: Monday to Friday 0900AM-1700PM (GMT+8)